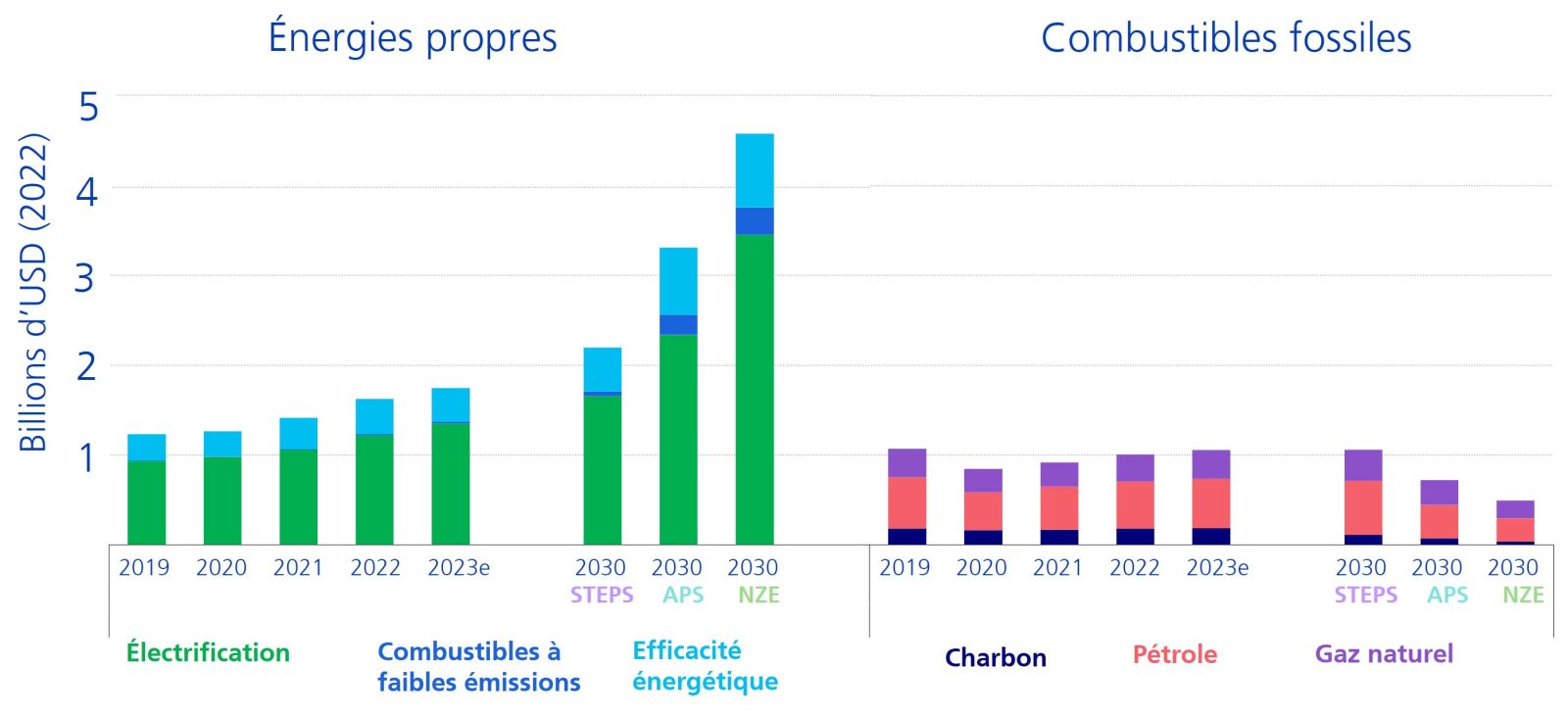

To reduce global warming, investment in clean environmental technologies should rise to 4.5 trillion USD by 2030.

To control the consequences of climate change, we need to promote renewable energies in a comprehensive and planned way.

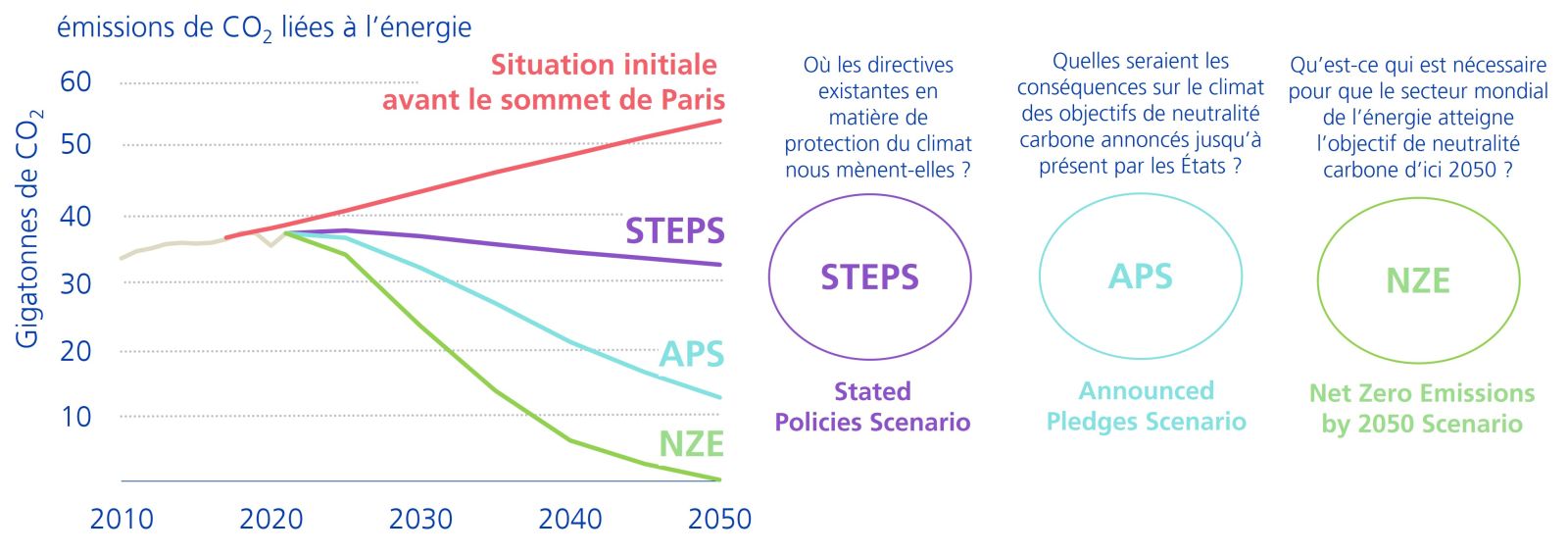

Global warming should not exceed 1.5°C by 2050. This was the target set in the 2015 Paris climate agreement, ratified by most states. If the 1.5 degree limit is exceeded, the consequences of climate change risk spiraling out of control. On this path, there are two important milestones to reach. Firstly, a reduction in global energy-related greenhouse gas emissions to 23 gigatons by 2030 from around 37 gigatons (2021 survey). Secondly, “Net Zero” must be achieved by 2050. This means that we must no longer emit more greenhouse gases than natural and technical carbon reservoirs can store.

To achieve these objectives, the International Energy Agency (IEA) estimates that investment in environmentally-friendly technologies, or “Green Energy”, will rise from USD 1.75 trillion in 2023 to USD 4.5 trillion, or USD 4,500 billion by 2030. Investment should therefore grow by 15% per year. This roadmap makes it possible to halve investment in fossil fuels without compromising security of energy supply.

Historical energy investments vs. needs in IEA 2030 scenarios.

(Source: www.iea.org; World Energy Investment 2023)

The IEA calls this scenario “NZE”, Net Zero Emissions. Only the NZE scenario generates net zero emissions in 2050 and is compatible with the 1.5°C climate target (see graph below).

Evolution of energy-related CO2 emissions according to the three key scenarios (STEPS, APS, NZE)

(Source: www.iea.org; World Energy Investment 2023)

The IEA has created two other, less ambitious scenarios:

The “Announced Pledges Scenario” (APS) assumes that all states that have announced carbon-neutral greenhouse gas emission targets implement them in earnest and begin to do so consistently within this decade. Under these conditions, investments in clean environmental technologies of 3.2 trillion USD by 2030 are required. This corresponds to annual growth of around 9%. By 2030, investment in fossil fuels is likely to fall by around 30%.

According to the IEA, a planned implementation of the APS scenario would reduce global greenhouse gas emissions by around 70% to 12 gigatons by 2050 (see Figure 2). The average global temperature rise in 2100 would be around 1.7°C.

The “Stated Policies Scenario” (Steps) assumes that current global climate protection guidelines will be maintained. Investment in environmentally-friendly technologies would be estimated at USD 2.15 trillion, equivalent to annual growth of 3% and therefore roughly equal to global economic growth. In this scenario, investment in fossil fuels remains unchanged at around one trillion USD.

In the STEPS scenario, global greenhouse gas emissions would fall by 13% by 2050. This would lead to an increase in global average temperatures of around 2.5°C by 2100..

ENVIRONMENTAL TECHNOLOGIES ON THE ROAD TO GROWTH

Investment in clean environmental technologies (wind power, solar power, heat pumps, electric mobility, etc.) will grow by 2030, regardless of the three scenarios described.

If the 1.5°C climate protection target is consistently pursued (NZE scenario), this will even lead to growth of over 15% by 2030 in all clean environmental technologies, or additional investments of 2.7 trillion USD. Even the STEPS scenario leads to growth, but not to above-average growth relative to the global economy.

SEPARATING THE WHEAT FROM THE CHAFF

One thing is certain: the availability and development of “Green Energy” is a major trend. This is also due to the fact that electricity production costs based on wind and solar power, for example, are now often cheaper than traditional electricity production from coal, gas or nuclear power. These cost advantages over fossil-fired electricity are set to increase further, as renewable energies become more and more advantageous, and CO2 is taxed in many countries.

Investors should ask themselves the following question: To what extent will the global community accelerate climate protection in the coming years? The growth potential of different environmental technologies varies according to the scenario.

In addition, investment decisions should be based on fundamental, company-specific analyses. After all, not all companies active in environmental technologies follow a profitable growth path. It is essential to know whether returns on capital will exceed the cost of capital in the medium term.

————————————————————————————–

Source: Allnews| 27 Jul 2023 | Gerhard Wagner, Swisscanto.

Gerhard Wagner, Senior Portfolio Manager Sustainable Investments

Gerhard Wagner is Senior Portfolio Manager for Sustainable Investments and has been working in asset management at Zurich Cantonal Bank / Swisscanto since 2008. Gerhard Wagner studied physics at the University of Konstanz. He then obtained his doctorate in natural sciences (Dr. rer. nat.) at ETH Zurich. In 2006, he qualified as a Chartered Financial Analyst (CFA).